RVC Angel/Venture Capital Membership for Investors

Successful angel investing starts with education, access, and community. Rockies Venture Club equips investors with the venture capital fundamentals, high-quality deal flow, and a collaborative network to invest confidently in early-stage companies. As the longest-running angel group in the U.S., RVC has helped thousands of investors participate in startup investing.

Courses presented by Peter Adams, author of Venture Capital for Dummies.

Education

Trusted advisors ensuring accurate, efficient, and optimized tax filings tailored to your unique situation.

Community

Meet investors, CEOs and management teams of innovative startups. Networking, events, pitch coaching, and experienced mentors.

Investment

RVC is comprised of expert investors focused on the most important thing - getting your company funded!

About Us

Angel/Venture Education is Key for Success

Don't be awkwardly unaware of how venture capital works. We have an extensive curriculum of two hour workshops for startup founders including topics like valuation of early stage companies, exit strategies, financial projections and analysis, due diligence, pitch critique, portfolio theory and market analysis.

RVC's education is the exact same curriculum that we provide to investors so we're all aligned on the terms, process and principles behind putting together deals that are win/win for everyone! We're the anti-sharks!

Services

What Does Membership Include?

Mentoring

RVC sees over 1500 deals a year and can afford to be very selective and pick only the best. The deal flow is curated by the RVC team and members may choose to participate in final screening, if they desire.

From Pitch to Check

Companies approved to pitch receive training and mentoring, a full due diligence report and connections to syndicate partners around the U.S. all at no cost to them!

Access to Investors

Startup members have access to investors, not just from up on the stage making a pitch, but in casual networking situations that foster one-to-one human relationships vs. a strictly transactional investment.

Syndication

We invest in the best deals anywhere in the country and many of the deals we see are "syndicated" to us and we share diligence and negotiation with other micro funds and angel groups. Startups moving through investment receive due diligence and syndication at no cost to them.

Events/Social Engagement

There are lots of ways to engage socially at RVC. It starts with face to face (and hybrid) meetings with peer investors, followed by lunch or happy hour.

Hybrid Events (in person/Zoom)

We have partners, investors and startups from all over the country and around the world who benefit from RVC's events via Zoom. Local members are invited to come in-person and follow-up for social events afterwards.

What Do We Look for in a Deal?

The RVC Investment Thesis

The Rockies Venture Club has made more than 200 investments over the past decade and while we can see some variation in the deals that have been done, there are definite themes that describe how the group makes decisions about the investments it makes.

Our thesis is divided into eighteen categories. Note that the reported objectives for each category are where the top of the bell curve falls for our investments. RVC is sometimes opportunistic and will make a Series H follow-on investment when the situation seems right,

even though this is a far cry from the pre-seed and seed stage deals we typically do.

Geography: Colorado and the West. Most of RVC’s deals are from Colorado or the Rocky Mountain West. Then, there are syndicate deals that are mostly from the western U.S. but can come from anywhere. Finally, we have done just a few international deals but expect to do more over time.

Stage: Seed/Pre-Seed. These stages are defined as post MVP (Minimum Viable Produce) but pre-PMF (Product Market Fit) RVC prefers early stage deals where we can lead the deal, influence the direction of the company (for the best), and seek outsized investment multiples

based on relatively lower initial valuations.

First Check Amount: $100,000 - $500,000

Concentration: Investments typically representing 20-50% of the funds being raised in a round and ownership of 5-20%. Note that concentration is not a primary strategy for RVC, but rather dollar on dollar returns..

Follow-on Strategy: A majority of RVC investments achieve follow-on rounds with a number of objectives including maintaining pro-rata ownership, avoiding cram-downs in pay-to-play situations, and benefitting from inside information to double down on winners. Total follow-on investment over a period of years can reach $2,500,000 or more.

Valuation: Market Rate Strategy averages $6-10 million in 2025 for first round investments. RVC seeks fair valuations that represent the company’s potential for returns at exit. First rounds of $10 million or more are rare, as are rounds of $4 million or less.

Capital Intensive Strategies: Companies that require extraordinary amounts of capital to succeed are generally avoided. Early stage investors see excessive dilution and exits need to be exceptionally high and far into the future in order to achieve desired returns.

Exit Strategies: Prefer companies with clear exit strategies including industry trends, recent comps, clear relationships being built with potential acquirers, multiple exit scenarios and an overall vision for understanding value creation by understanding the gaps in incumbent

companies' playbooks.

Strategic Advantages: Most deals require “Moats,” which represent barriers to entry by competitors. Moats could include network effect, proprietary data sets, strong existing market share, intellectual property and patents, strategic partnerships, and proprietary technology.

Target Returns: The target return is 10X over five years. Under appropriate circumstances, early exits of 2-3X and “power law” later-stage exits of 100x or more are also considered. In all cases we look for strategic validation of target returns and detailed tactics to get there.

Deal Structure: Preferred Equity investment in C-Corporations. RVC prefers equity investments due to tax advantages and more clearly defined terms and governance. Convertible Notes and SAFEs are considered for exceptional deals, or true “bridge” investment situations.

Tax Strategies: RVC considers tax strategies for federal and state taxes when structuring deals because they can impact cash returns significantly.. When possible, RVC will claim OEDIT

Advanced Industries Investment Tax Credits from the State of Colorado and IRS tax breaks for angel investors, known as QSBS Section 1202, 1244, 1045 tax breaks at exit.

Boards: Yes. RVC achieves board representation in about 40% of its deals, primarily because RVC leads many of its rounds and that can lead to board seats.

Observer positions when a board seat is not available or when later round investors take existing seats. In any case, RVC requires investor representation on the board even if it is not from our group.

Leading Deals: Yes. RVC prefers to lead deals, but will follow when an attractive deal is presented that has been negotiated and structured by syndicate partners. RVC leads deals because it does formal due diligence, it has a syndication network, and it prefers to guide deals

towards tax advantaged structures.

Industries: Agnostic. RVC is technically agnostic, but its deals tend to concentrate in life sciences, cleantech, CPG and tech deals.

Teams: RVC prefers teams of three people or more, ideally with venture-backed experience, strong strategic backgrounds, clarity of strategy and purpose, unique industry perspectives, a focus on building value through exit, demonstration of “grit,” or other uniquely qualifying characteristics.

Company Structure: RVC typically invests in companies organized as a Delaware C-Corp, sometimes after converting from an LLC.

Syndication: RVC actively creates syndication opportunities with our partners around the State and the U.S. in order to help startups fill their rounds. We also seek out the best investments from our syndicate partners around the country.

1,500+

Dealflow Pipeline Annually

100+

Active Investor Members

100+

Speakers

8HR

Workshops

RVC is more than just an angel investing group. It's a community of like-minded people with varying backgrounds that support the startup community.

Let’s join together

100+

Events and meetings each year

~75

Pre-vetted deals presented annually

Why Choose Us

What Makes Us the Right Angel/Venture Capital Partner

100% Trusted Rate

RVC is the longest running angel group iin the USA, operating as a community leader for over 40 years.

Industry Agnostic

We invest in technology, AI, life science, cleantech, CPG and other industries that have the ability to return 10 times our investment or more in five years. Our broad community gives us expertise in multiple industries.

Investing Know-how

We're investors who are transparent about what investors look for, how venture capital works and fully sharing the investor perspective so that founders have the best opportunity for success!

Community Support

We educate and empower communities through free and paid events and workshops.

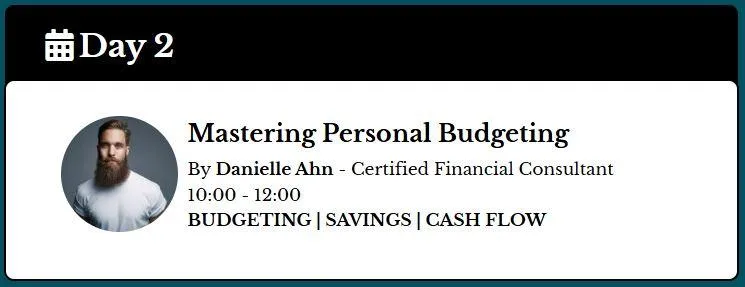

Upcoming Events in 2026

January

January

Angel 101

By Peter Adams - RVC Executive Chairman

Learn the landscape of venture capital and angel investing. We cover everything from valuation, diligence and tax strategies to how venture capital funds work.

Pitch Academy

By Kevin Kudra - RVC Executive Director

A workshop to coach startups in presenting the best pitch and much more. Investors get an early view of the companies and can provide mentorship if desired.

January

January

Angel Forum

By Kevin Kudra - RVC Executive Director

Meet with other investors to see pitches from new companies and to review the "deals in play" with completed due diligence and term sheets negotiated. Ask questions, share insights and learn from experienced investors.

Funding Mastermind

By Peter Adams - RVC Executive Chairman

Get together with other investors and bring your questions. Term sheets, diligence, valuation, or whatever you're curious about.

Pricing Plans

Flexible Membership Levels to Match Your Needs

$297

per Month

Everything in Free and Startup Pro, plus

- Free access to all RVC Live, Online, and Hybrid conferences and events.

HyperAccelerator Program

• Intensive accelerator experience with live mentors, certification, and Demo Day.

• Weekly cohort calls featuring live coaching, pitch presentation & defense, peer discussion, and Q&A.

• 1:1 live mentors for every module.

Founder Masterclasses & Deep Dives

- Pitch Academy — advanced pitch techniques with live feedback.

- Valuation Workshop — five valuation models for pre-revenue and early-revenue startups.

- Term Sheets, Negotiation & Deal Structure — founder-aligned deal strategies.

- Exit Strategy Workshop — design your exit early using the Exit Strategy Canvas.

- Scaling with OKRs & Strategic Planning Frameworks.

- Go-to-Market & Channel Strategy — key sales metrics and traction planning.

- Pro Formas & Financial Projections — build believable five-year models.

- Due Diligence Mastery — legal prep, data rooms, and tips to win investor diligence.

$97

per Month

Everything in the Free Membership, plus

- 50% discount on all RVC Live, Online, and Hybrid events.

Weekly Founder Coaching & Pitch Support

- Weekly Live Q&A Coaching Sessions — consistent guidance as you build and grow.- Pitch Academy — learn how to craft and deliver a compelling startup pitch.

- Quarterly Pitch Reviews — get structured feedback to sharpen your story.

Fundraising Tools & Knowledge

- Venture Capital ChatGPT Knowledgebase — on-demand answers for fundraising, strategy, and investor conversations.

- Pitch Review Support — refine your pitch for real-world investor meetings.

Startup Growth Infrastructure (GHL CRM)

- Full GHL CRM System, including:

AI inbound & outbound voice agents

Email campaigns and automations

Landing pages, website hosting, and funnels

AI web assistant with your custom knowledgebase

1,000+ pre-loaded VC & Angel investor contacts

Cold outreach email templates and workflows

Free

Startup Community & Visibility

- Interactive community to ask questions, share insights, and collaborate with fellow founders, investors, and ecosystem partners.

- Post your company on SparkXYZ to apply for pitch opportunities and increase visibility.

Founder Education & Support

- Angel Investing 101 Webinar — understand how investors think and what they look for.

- Monthly Live Q&A Coaching Session — get answers to your startup questions in real time.

Events & Ecosystem Access

- 10% discount on all RVC Live, Online, and Hybrid events.

100% Trusted Quality

Backed by over 40 years of industry expertise, we deliver venture capital funds for a professionally managed diversified portfolio or SPV investments for founder friendly deal structures and funding.

Our Team

The Experts Guiding Your Financial Future

Peter Adams

Executive Chairman

Kevin Kudra

Executive Director

Follow Us

© 2025 Rockies Venture Club - All Rights Reserved.